Comparing Today's Housing Market to our Previous 'Unicorn' Years Doesn't Add Up: Here's Why!

Attempting to compare housing market metrics between different years can be quite difficult in a typical housing market scenario. However, it's important to note that the past few years have been far from ordinary. In fact, they can be described as extraordinary or "unicorn" years due to the unprecedented economic state brought on by the pandemic. In this article, we will explain why you shouldn’t compare today’s housing market to the state of the market in 2020–2022.

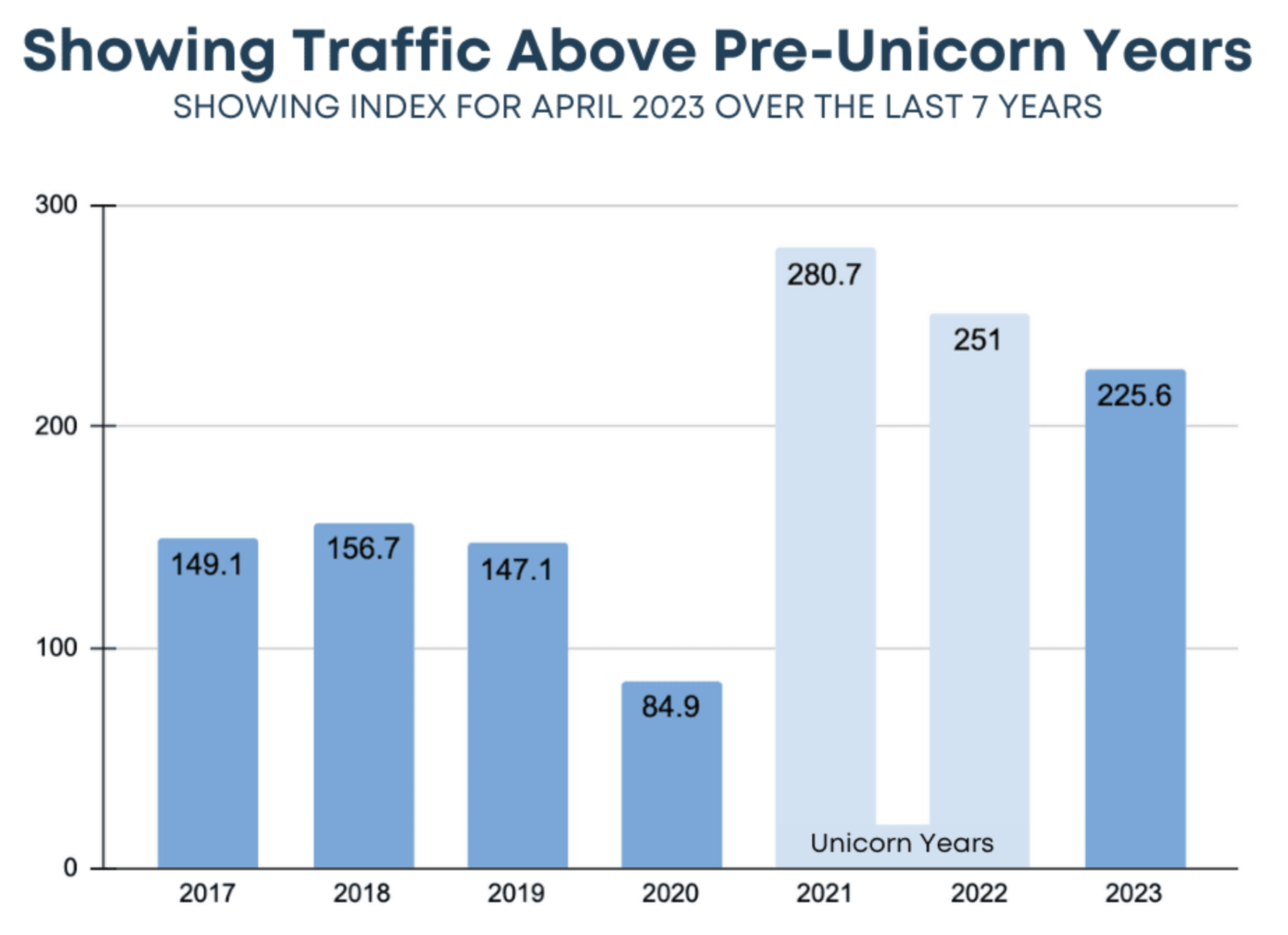

While lower to the last couple of years, home buyer activity is stronger than it was pre-2020.

Pre-2020, the average buyer activity index was 151. Now, the buyer activity index is at 225.6, which is a 50% increase from pre-unicorn years! Despite a slight decline compared to the past couple of years, the level of home buyer activity remains notably stronger than the pre-2020 period.

Before 2020, the housing market operated within a relatively stable and predictable environment. However, the onset of the global pandemic brought about significant changes in buyer preferences and priorities. As people spent more time at home and sought greater space and comfort, the demand for housing surged.

While the current level of home buyer activity may have dipped slightly compared to the peak of the post-pandemic surge, it remains significantly higher than the pre-2020 baseline. This indicates an improved level of interest and engagement among buyers in the housing market.

Home prices aren’t truly crashing, they are returning to a more normal and predictable rate of appreciation.

The current situation with home prices may appear alarming at first glance, but it's crucial to understand that they are not undergoing a true crash. Instead, what we are witnessing is a correction, where home prices are gradually reverting to a more sustainable and predictable rate of appreciation.

It's important to approach these changes with a balanced perspective. The adjustment in home prices is not an indication of a market crash or a decline in the value of homes. Rather, it signifies a return to a more sustainable trajectory, offering a healthier and more predictable environment for both buyers and sellers.

While rising, foreclosure filings are still lower overall. There is no flood of foreclosures today.

Although there has been a recent increase in foreclosure filings coming out of the unicorn years, it's important to understand that they remain relatively low compared to historical levels! Today, the number of foreclosure filings is 46% lower than the average between 2017–2019.

Why the drop in foreclosure rates during the pandemic? Foreclosure rates were significantly lower during the pandemic due to government moratoriums, mortgage forbearance programs, stimulus measures, and other efforts to stimulate economic recovery. These interventions provided relief and financial assistance to homeowners, preventing a surge in foreclosures and allowing individuals to stabilize their finances amidst the challenging circumstances.

Conclusion

Comparing housing market metrics between years can be difficult, especially during atypical periods like the recent 'unicorn' years. You may have already seen unsettling housing market headlines this year, mostly due to these unfair comparisons with the ‘unicorn’ years. However, comparing our current housing market to the market before the pandemic, you’ll see that buyer activity is actually 50% higher, home appreciation is back to a regular and stable rate, and annual foreclosure filings are much lower than average! If you’re interested in receiving more information, let’s connect to share some data that puts these unsettling headlines into perspective.